Payment Flow: How Do You Buy or Sell Goods?

Payment flow is more sophisticated than most people think,

so let us figure out how to accept online payments and pay for goods online.

Online shopping, as well as various digital services, are becoming more and more popular nowadays, increasing the need for online payments. From a user’s perspective, online payment is an easy and quick way to pay for goods or services, but in fact, payment processing is a pretty sophisticated system that involves a lot of processes. So, what exactly is payment flow, and how does it work for both customers and business owners? This is what we will discuss in this article.

Payment Flow for Users

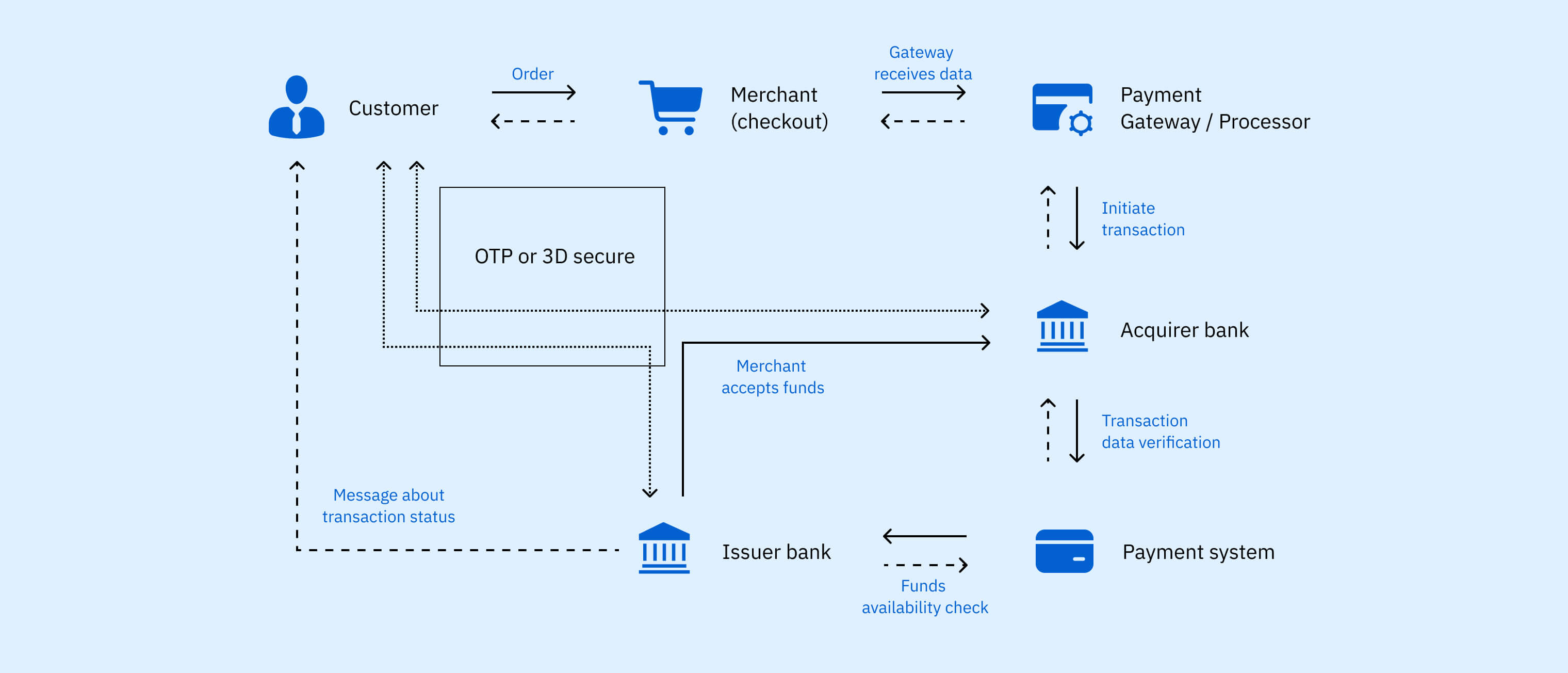

As a customer, you most likely won’t experience any issues while paying for the goods or services you need online. Pretty much all the websites that sell anything have an online payment gateway that makes payment flow for customers simple and quick. In particular, when a user is ready to make a purchase, they click on the Proceed to Checkout button (or whatever this button is called on each particular website), select a payment method, and provide their payment info, like card number, CVV code, etc. As a rule, that is enough to charge a card, yet today, most online businesses use an ecommerce payment gateway with a 3D secure system that requires a customer to confirm every payment on their bank app or via a phone call. After this quick verification, your card is charged, and you can wait for your goods to be delivered or start using your digital services right away.

So, as you can see, online payment flow for customers is pretty simple and stress-free, which is extremely important for conversion rates. However, providing this simplicity is more challenging than most people think, and accepting online payments is a rather sophisticated affair.

Payment Flow for Businesses

When it comes to accepting online payments by businesses, everything is a little bit more complicated. First of all, any online business has to arrange proper payment orchestration and integrate a decent payment gateway on its website. As a matter of fact, finding a good payment orchestration provider is rather challenging on its own, but luckily Germius has got you covered here, so you can save some time and effort. Thus, once you have a payment orchestration platform and are ready to accept payments, the most interesting part begins.

So, how to accept online payments? In a nutshell, the payment flow for an online business is the following:

- A customer (cardholder) decides to make a purchase, selects one of the available online payment methods, provides their payment data, and submits.

- The merchant captures the payment from the customer and navigates it through the card networks, like Visa, Mastercard, etc., to the issuing bank, ensuring the merchant receives their rightful due.

- A business (merchant) accepts the payment.

On rare occasions, acquires can involve third parties to help process payments. In particular, online payment services providers often offer payment organization schemes that help protect your merchants from overloading and, therefore, guarantee smooth payment flow regardless of your business’s location, size, etc.

PCI and DSS Certifications

As we have already mentioned above, online payment flow for businesses is particularly sophisticated, and having good payment gateway providers is sometimes not enough for accepting online payments safely. Among all the things business owners have to deal with in terms of payments are PCI and DSS certifications as well.

The Payment Card Industry (PCI) and Data Security Standard (DSS) certifications are crucial security measures created and used by most major payment systems, including Mastercard, Visa, American Express, and Discover. Thus, every business that has at least one online payment a year has to meet PCI and DSS requirements. Otherwise, your business will be fined every month until you get the certification, and the fine amount is rather considerable — about $100,000. Additionally, the lack of these certifications eventually leads to data breaches, which results in your customers losing money and your business losing its reputation.

So, how to acquire PCI and DSS certifications? Here are some steps you will have to make on your way to safe payments:

- Create a safe network infrastructure

- Protects your customers’ payment data

- Follow the information safety policy

- Ensure the operation of threat and vulnerability management programs

- Implement measures to control access to any data

- Conduct continuous network monitoring and auditing

Completing the above-mentioned tasks will not only help you get PCI and DSS certifications but also protect your business and your customers from data leakages and the terrible consequences they bring.

PCI DSS Levels

Though having both PCI and DSS certifications is crucial for any business, getting them is often not as easy as you may think. In fact, there are four levels of PCI DSS depending on your money flow. These levels have different requirements, so let’s take a brief look at those:

-

Level 1.

This applies to merchants that process over 6 million transactions per year. The certification requires submitting a Self-Assessment Questionnaire (SAQ), an annual report done by a qualified security assessor (QSA), a quarterly scan of your network done by an approved vendor, a penetration test once a year, and an Attestation of Compliance (AOC) form. -

Level 2.

If your business processes from 1 to 6 million transactions per year, it falls under the level 2 category, and you will only need to submit just a Self-Assessment Questionnaire. An annual report is only necessary if you are a victim of a data breach. Among other requirements are a quarterly scan of your network by an approved vendor, an annual penetration test, an internal scan, and an AOC form.

-

Level 3.

In case your business processes between 20,000 and 1 million transactions a year, you will most likely have a level 3 certification. It requires you to complete an SAQ, send a quarterly network scan for vulnerabilities, and submit an attestation compliance form. -

Level 4.

This applies to businesses that process less than 20,000 transactions per year and have not been victims of cyberattacks and data leakages. For this certification, you will just need an AOC, quarterly vulnerability scans of your network, and an SAQ.

Of course, getting even the level 4 certification is quite challenging as well as time- and money-consuming, which is why many businesses choose to use these certifications within a payment gateway. Indeed, this way of getting PCI DSS is way simpler and makes it possible to get these certifications, even for small businesses.

Final Word

Payment flow for businesses is pretty challenging, and installing an online payment gateway, arranging proper payment orchestration, and getting all the required certifications for your business’s website is going to be one of the most difficult and time-consuming things you will have to deal with. Luckily, Germius has your back here, and you can definitely count on us while arranging online payment services for your e-commerce or subscription business website.