What Is Payment Orchestration and How Does It Work?

Payment orchestration is one of the most essential features for all online businesses,

so let’s find out what exactly it is and how it works.

Nowadays, we cannot even imagine an online business without proper payment orchestration since the ability to make and accept payments online is essential for most businesses, whether it is a food delivery service, a dating site, an online marketplace, or any type of subscription business. But what is payment orchestration? How does it work? And why does every online business needs a reliable payment orchestration platform? Let’s try to answer these questions together in this article.

What Is Payment Orchestration?

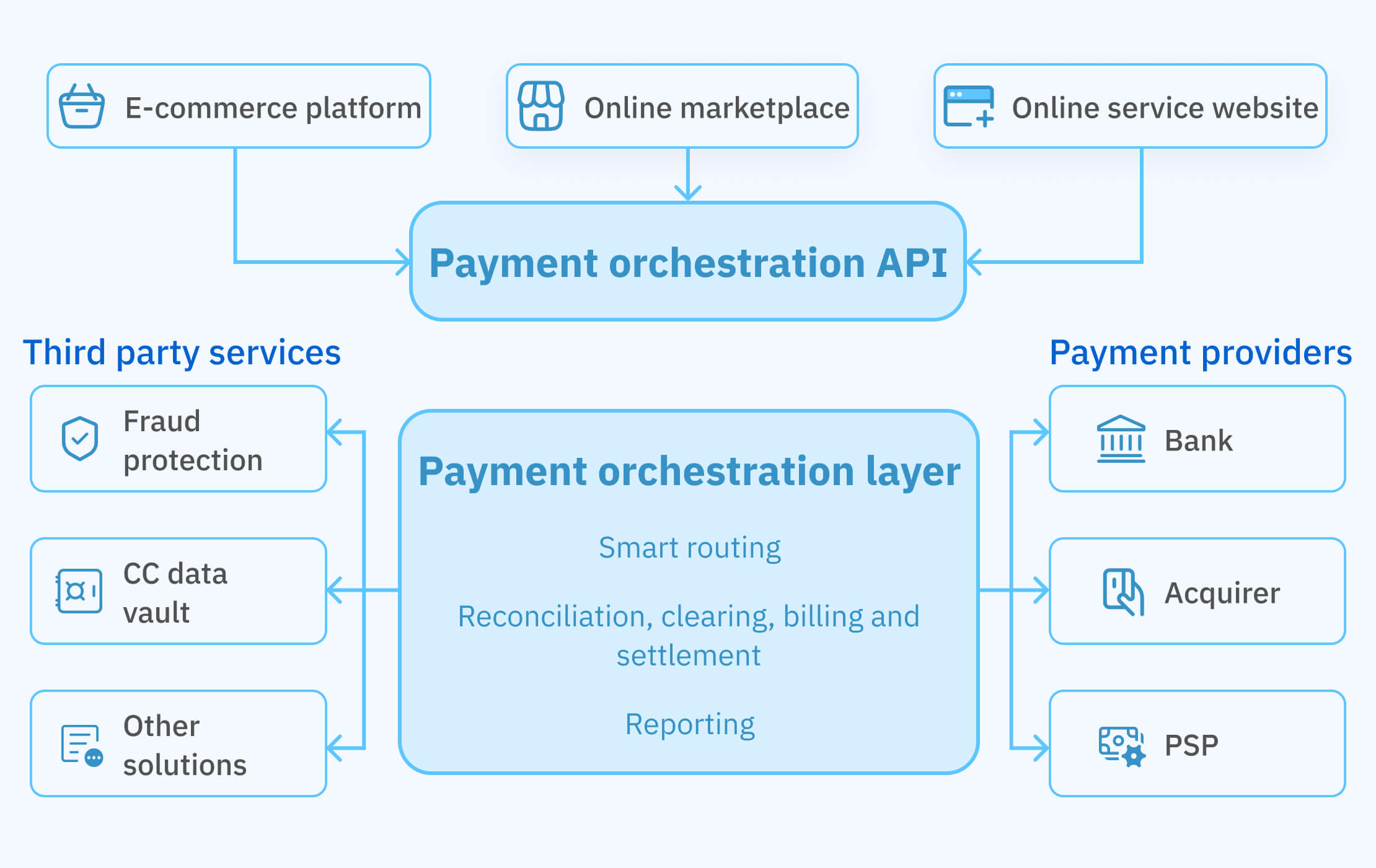

Payment orchestration acts as a central coordinator in the world of online transactions. It consolidates the management of various payment service providers, acquirers, and banks into a single platform. This unified system oversees the entire payment journey, ensuring a smooth and efficient flow from customer checkout to successful fund transfers for the business.

While payment authentication, multi-PSP routing, and settlements are core functionalities, payment orchestration offers a broader spectrum of services. It encompasses robust risk management strategies to safeguard the financial ecosystem. Secure customer data storage is prioritized, ensuring information remains protected. In essence, payment orchestration acts as an invisible conductor, guaranteeing a seamless and secure online payment experience for all.

To put it simply, payment orchestration software allows accepting and making online payments regardless of a payment method, therefore, providing the ability for online businesses to easily charge their customers. Thus, top payment orchestration platforms make online purchases possible.

Why Is Payment Orchestration Important?

As a rule, financial services for online businesses are provided by payment orchestration companies like Germius. In fact, for a business owner, it’s perhaps the most convenient and affordable option since getting payment gateways and all the required certifications yourself is pretty challenging and expensive. So, obviously, it’s best to just buy a ready-made solution since if you cooperate with a payment orchestration provider, you get all the required features and services — all in one place.

Basically, after getting payment orchestration services from a company like Germius, you just forget about all the troubles and start accepting payments. That’s pretty much how it works in most cases. However, payment orchestration is way more than just accepting online payments. As a matter of fact, payment orchestration providers offer a wide range of features that will enable your business to securely accept payments. In particular, these services often include integrations with payment gateways and all the mandatory certifications, chargeback prevention, fraud protection, and more. So, in a nutshell, from the point of view of a business owner, payment orchestration works pretty simply — it makes sure your website can safely accept online payments and allows you not to worry about anything.

Payment Orchestration Workflow

Of course, technically, payment orchestration is way more sophisticated than most business owners might think. In fact, payment processing is a pretty complicated deal and involves a lot of operations that happen in a matter of mere seconds. So, to help you understand how payment orchestration works and, at the same time, not to bore you with tons of technical information, we suggest you take a look at the following scheme.

Why Do Businesses Need Payment Orchestration?

It seems like the answer to this question is super simple since we all understand that any online business needs a payment orchestration provider to be able to accept payments. But why payment orchestration platform and not just a good old gateway? Let’s take a brief look at the main reasons for cooperating with the best payment orchestration platforms.

-

Ability to have multiple gateways at the same time.

Payment orchestration platforms allow you to have several payment gateways if you have more than one merchant, thanks to which you don’t need to have separate integrations. -

Affordability.

In the long term, a payment orchestration platform is more affordable than using a traditional payment system. -

Convenience.

Top payment orchestration platforms offer a wide spectrum of features that will help you secure your merchants and protect your business — and you get them all in one place. -

Improved customer experience.

Most customers abandon a purchase if the checkout process is too complicated, but payment orchestration software eliminates this problem.

-

Simple payment integrations.

Unlike traditional gateways, payment orchestration providers often allow you to easily and quickly accept international payments. -

Supreme payment security.

The best payment orchestration platforms provide high-level security for your payments, safeguarding your business and your customers. -

Reporting and analytics.

Most payment orchestration providers, including Germius, offer excellent reporting and analytics features that will help you better understand your clients, find the right approach to them, and increase your sales. -

Variety of payment methods.

As a rule, payment orchestration companies provide a great selection of payment methods, which has a great impact on conversion rates and sales.

These are just a few benefits of using a good payment orchestration platform, but they are more than enough to convince most business owners to choose a payment orchestration system over traditional gateways.

Final Thoughts

As you can see, payment orchestration is an essential component of any business website, without which most online businesses just cannot operate. So, if you feel like your business needs a reliable payment orchestration provider, feel free to reach out to us, and we will help you find the best solution for you.