Payment Gateways: Definition, Types, Purposes

Payment gateway is an essential feature of any business, but which one to choose?

Let’s take a look at payment gateway types and what they are used for.

We live in the era of online businesses — the time when you can get pretty much any product or service online. This is truly amazing, but what is even more fascinating is the technology behind it. One of the tiny things that make it happen is an online payment gateway, but what exactly is it, how does it work, and, most importantly, why does your business site need a payment gateway? Let’s try to answer all these questions together.

What Is a Payment Gateway?

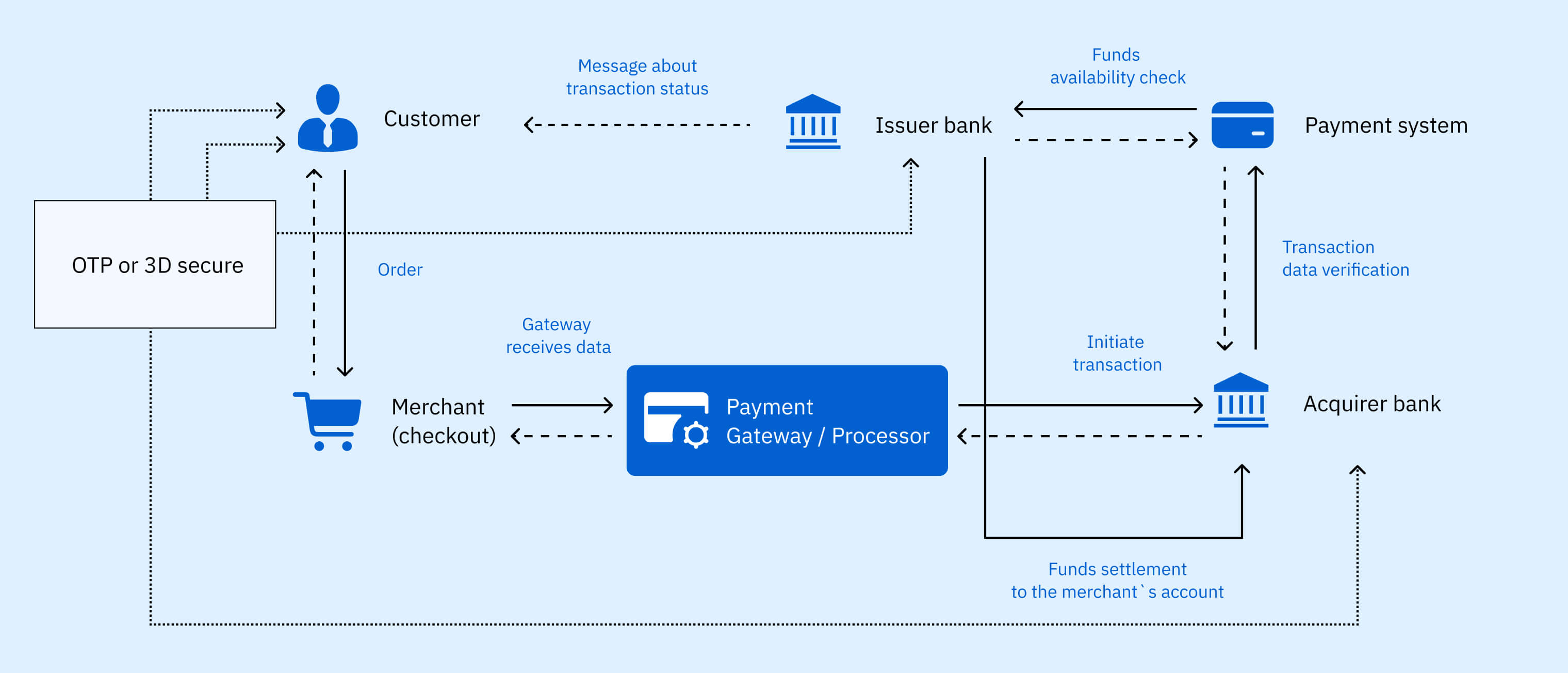

Many people believe they know what a payment gateway is, but pretty often, they struggle to define it. So, what is a payment gateway exactly? Let’s try to answer this question once and for all. Basically, a payment gateway is a secure intermediary between a merchant and a customer during a money transaction. It is like a bridge that connects a merchant’s bank and each customer for further authorization and settlement. In terms of the exact things payment gateways do, most of them have the following functions:

- Secure collection of a customer’s payment data

- Transmitting the data for authorization

- Facilitating communication between banks

- Settling transactions

As you might have already, a credit card payment gateway is required for any type of online money transfer, which makes it a crucial feature for any business website, regardless of its type.

Payment Gateway Integration Types

Certainly, there are many types of payment gateway services, and for business owners, it’s particularly important to select the one that will work best for their business. As a matter of fact, the choice of the right payment gateway depends on plenty of factors, so let’s first take a look at the most common payment gateway types and their usage and then proceed to which option is the best.

Hosted Payment Gateway

Hosted payment gateway integration is perhaps the most common type used by hundreds of thousands of online businesses all over the world. This gateway redirects customers to a secure payment page on the gateway’s website, where customers enter their payment info and submit payments. This type is pretty secure as well as simplifies the entire process for merchants since sensitive payment data never goes through the merchant’s website, which is the reason for the high popularity of hosted payment gateways. Some of the most popular hosted gateways examples are PayPal, Amazon Pay, Unicorn Group, and Opayo.

Self-Hosted Payment Gateway

Unlike hosted gateways, self-hosted ones use merchant’s websites for collecting customers payment data, and then the merchant submits this info for authorization and settlement. Such a system provides merchants with more independence and control over transactions. However, this also obliges merchants to obtain the Payment Card Industry (PCI) and Data Security Standard (DSS) certifications, which is often pretty challenging and rather expensive.

API-Hosted Payment Gateway

API-hosted payment gateways are quite similar to self-hosted ones in terms of their workflow. The main difference between these two types is that API-hosted gateways do not submit payment information directly to the gateway. In fact, they use an application programming interface (API) to connect to the gateway and process the payment. This type provides merchants with more freedom, but it also requires sophisticated technical backup.

Local Bank Integration Gateway

As you might have already guessed, it’s not an international payment gateway, but local bank integration perfectly works for small and medium local businesses. This type allows customers to pay for products and services using local payment methods and bank transfers, which is pretty secure and comfortable, and it works great for selling goods in specific locations. At the same time, it is not a solution for international businesses, so they have to look for other payment gateway providers.

Which Gateway to Choose?

There is no such thing as the best payment gateway since everything depends on the size of your business, your budget, the needs of your customers, and many more. So, there is no universal payment gateway type that works for all. In fact, in many cases, an online payment gateway is not the best solution at all since it makes more sense to get a full spectrum of payment orchestration services that will provide you with all the required features, functionality, and certifications, as well as take care of your payments’ and merchants’ security.

So, if you are curious about your options and want to find out which one will work for you, feel free to contact us, and we will help you find the best solution for your business.

Wrapping Up

Getting payment gateway services is crucial for any online business since, without them, you simply won’t be able to charge your clients for your goods or services. However, the selection of payment gateway types is vast, and the choice is not the easiest to make, so sometimes it makes more sense to get all the payment features for your business website within a payment orchestration provider like Germius. Therefore, take your time to think and select the best payment gateway for your business.